Environmental 360 Solutions has quickly become a major player in the Canadian waste market. Now, after more than 86 acquisitions, it’s looking to expand into the U.S.

CEO Danny Ardellini founded the company, known as E360S, in 2018. This followed a career in the industry that included selling another business to GFL Environmental in 2008. E360S launched with backing from investors such as a smaller private equity firm and a hockey star, before selling a majority stake to BlackRock in 2023.

Since then it’s picked up the pace of acquisitions to gain a presence in Alberta, British Columbia, Ontario, Quebec and Saskatchewan. Some of its latest deals include the purchases of Rupert Disposal and Profusion in August.

The company is currently generating close to 1 billion Canadian dollars in revenue and has over 750,000 customers. It operates dozens of waste and recycling facilities, including one landfill in Saskatchewan.

Ardellini attributes part of this growth to offering equity stakes to acquired companies as well as creating a culture that gives more autonomy to E60S’ approximately 2,700 employees. As one example, E360S acquired a family business in Montreal where the son had only worked in the field. After receiving management and financial skills training the person has expanded sales significantly in the market.

E360S is now looking to bring this approach to U.S. markets where it can become either the No. 1 player or No. 2 behind a publicly traded competitor. The company plans to focus on MSW, but could also pursue environmental services opportunities as they arise. This is coming years later than originally envisioned, including a pandemic interruption, but Ardellini said it was necessary to wait until the company was ready to expand at scale.

Waste Dive recently spoke with Ardellini about lessons learned in Canada, extended producer responsibility regulations, plans for the U.S. and more.

This conversation has been edited for length and clarity.

WASTE DIVE: What has the BlackRock investment meant for you in terms of acquisitions and organic growth opportunities in the past couple years?

DANNY ARDELLINI: The BlackRock investment has been really, really good for us. It's a big name behind our company to give us some credibility to continue the growth of business. They've been very supportive in helping us not only grow the business but prepare our back office and giving guidance on getting us ready for the next stage of our growth.

So even though over the last 24 months we've been acquiring companies, we've been spending most of our time on our back office and putting the right people and the right systems in place so we can monitor the right KPIs and have them at our fingertips to double the size of this business over the next 24 to 36 months.

When you started the company it was more focused on hauling, but you had goals for vertical integration. What is your current landfill and vertical integration strategy?

We're not like the publicly traded [companies] that are very landfill focused. We're more sustainability focused. So we look at how we could divert stuff from landfill first. We only have one landfill, which is a necessity for our environmental service business more than our solid waste business.

So we've been putting our capital into processing facilities that can divert from landfill. An example is we opened up the largest C&D recycling facility in Montreal, Quebec, and that [has capacity to process 400,000 tons per year]. C&D is banned from the landfills in Montreal. So it's a huge advantage for us.

Could that ever change in the future in terms of landfills? Point taken that you're diverting as much as possible, but I'm sure there's still some MSW that you're sending to competitors now.

Correct. We send stuff to competitors right now. It’s about when we enter in a market, what's the disposal strategy. So do we need our own disposal outlets? In some markets, we have transfer stations.

We're only in Canada right now. We plan to enter the U.S. next year. So it's all about the market we enter and focusing on the disposal strategy. As long as we have a strategy for disposal and we can't get squeezed out of that market, then if it's owning a landfill, we have to own the landfill. If it's owning a transfer station, we have to own the transfer station to protect our market share.

Back in 2018 you mentioned that entering the U.S. was a goal, but that hasn’t happened yet. Why not yet, and why next year?

We needed the company to get to a scale in Canada from a financial point of view, number one, but more importantly, from a corporate structure point of view of having all the right pieces in place. Making sure we have our integration team lined up, making sure we have the proper IT systems, making sure we have the proper people in place.

Now, when we enter the U.S. market our Canadian back office can support in the initial stages the acquisitions we acquire, until we scale there to build our own back office out in the U.S.

What will differentiate you when competing for acquisitions in the U.S.? In 2018 you mentioned that offering an equity stake helped you win deals over other larger companies. Is that still the approach?

That's still the approach. We have a lot of opportunities in our pipeline for U.S. expansion and it's all focused around that approach. We are building something here. We’re currently the 13th largest North American waste hauler, which is pretty impressive for only being in Canada. And our goal, over the next call it four to five years, is to become the seventh largest.

We can't compete with the Republics or the Waste Managements of the world on what they can pay for acquisitions. The medium to smaller ones, we compete with them very well. But the larger [deals], obviously we can't compete with them. But where our advantage is is that if somebody wants to roll equity into E360 and be part of a bigger picture there's more upside than completely selling off the company to a Waste Management or a Waste Connections.

When I started the business it was me who rolled into GFL. I did very well in a short period of time and that's what I sold the early equity rollers on. Now we have a track record of six years of equity rollers, and their average return per year is 30%. Most of them, if not all of them, have made more money owning E360 stock than they have running their own businesses.

Any lessons learned about integration and what else helped you compete for those deals in Canada?

The funny thing is when you think you've learned it all you haven't. Every acquisition you learn something new all the time. I think what's led us to be successful in Canada is the equity roll positioning. We're competing against GFL here in Canada, and they're tough competitors.

And it's about finding those gems out there, those great companies in secondary markets that have higher margins that has allowed us to improve E360's margins.

And more importantly our goal is when we're doing these acquisitions — and a lot of our acquisitions are beachheads because we're still new in the game — that the owners or founders or their sons stay on board and continue running the businesses. Because if they would have sold to a GFL or to a Waste Connections or Waste Management, they already have the infrastructure in place.

We've been very fortunate over the last seven years to find those right beachheads where the owners stay on board, and then those tuck-in ones those owners don't want to stay on board. They usually just want to leave the business.

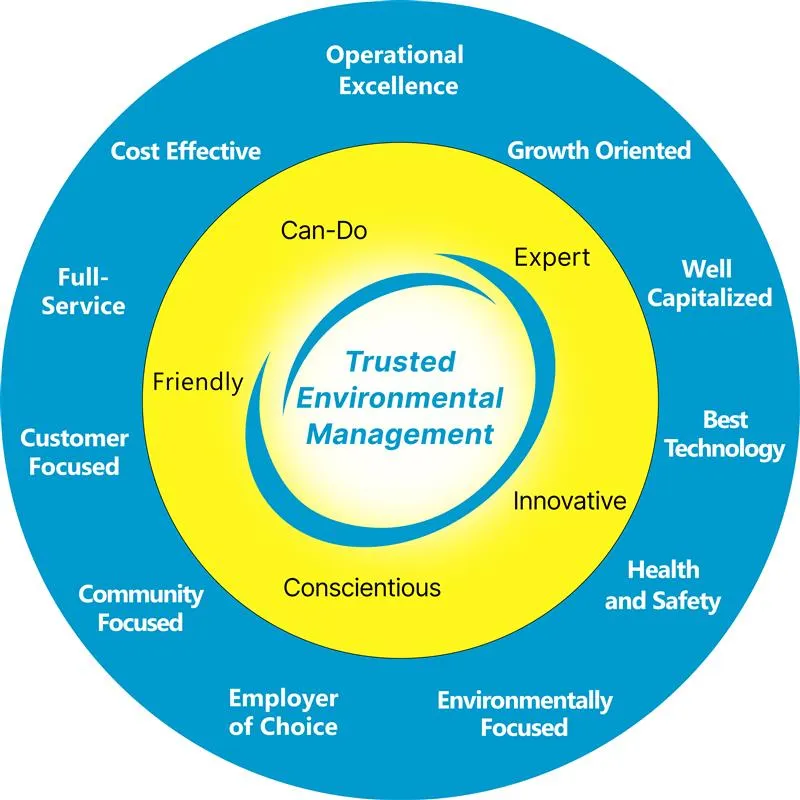

Plus, one thing that's that we've done from day one is make sure we create a culture, and we have a bullseye that talks about our culture. When we do an acquisition, we go in on day one to talk to all the employees, and we talk about the culture of E360. And our integration team does a really, really good job on pushing the E360 culture.

What’s different about E360’s culture?

Our culture is very entrepreneurial driven. Something that I work hard on as the CEO of the company is that we make sure that we don't get caught up in corporate bureaucracy and that the decisions are made — right or wrong — in the field.

We give our operators a lot of autonomy to make the decision. We're there to coach and support. We always say, when we go to visit divisions we're there as guests. When I show up to divisions or our COO shows up to divisions we treat it as we're visiting somebody's house. Instead of treating it like the big corporate guys from head office are coming in and putting the hammer down.

[Another] thing that this company's done from day one is we groom a lot of our own operators. So when you're grooming your own operators, you're grooming them the way of the E360 culture [rather] than the culture that they've been stuck with maybe in the past. Or they haven't had a culture, or they haven't had experiences of running a business.

How has extended producer responsibility factored into the business model for your recycling investments?

We're bidding lots of EPR programs now. We have probably over $250 million to $300 million of tenders out there right now of capital that we will need to build facilities.

We built a tire recycling facility out in Montreal, Quebec, to handle the EPR program out there. And we have a battery recycling facility in Ontario to handle the battery EPR program.

But from the Blue Box point of view, we're tendering those opportunities as they come about and we have the capital to be able to to put those facilities up. I know we're working on a bunch in B.C., and we're working on a bunch in Alberta and a bunch in Quebec right now.

All this talk started around 2014, 2015, so all the big majors like the GFLs and the Waste Managements in the world were staking their flag in the ground back then. E360 didn't start up until 2018, and really didn't get on the map until 2021, 2022, to be a player in the market.

So in the early days we had the door shut in our face a number of times when opportunities came about, and especially in Ontario. But we've been fortunate now that we've got a name for ourselves out there, and we've won a couple tenders and proven that we could operate on the municipal front. Now these people that run these EPR programs are coming to us and looking for an alternative. And we are the alternative to the majors.

It’s been a turbulent time for the U.S. and Canada, due to tariffs and other factors. What has this year looked like for you from an economic standpoint?

As all the majors will tell you as well, volumes are down. And we gotta be price conscious.

This is a year that we've been very focused in on margin improvement on our side. So whatever the economics world throws at us, we just gotta be able to shift and maneuver to make sure that we're getting the right returns for our investors, and having the investors believe in our management team to continue to invest in us.

So yes, we've had different challenges this year with tariffs. You're bidding these long-term contracts and you don't know if there's going to be a 25% tariff charge on it, or a 10%, or nothing. So you're monitoring all that, and you're figuring out how to tend these contracts and be competitive.

But on the flip side, as long as we focus in on our business and we make sure we're operating it correctly, and we're making sure that we're efficient in what we do, the waste industry can sustain all that's thrown at it. We're very fortunate that it's a recession-resilient business. We found out it's a pandemic-resilient business.

I remember when the pandemic happened and we shut down everything. Everybody stayed at home. We were still a new company. We were less than three years old. I thought I lost my whole business. I thought the business was going to go under. But what I didn't realize was people are at home cleaning out their garages. So instead of our big roll-off truck coming over the scale with three tons of garbage, I service 30 cars at our transfer stations to get three tons of garbage. And it was funny, we never lost a heartbeat. So our margin stayed the same.

What should we expect from the company in the next few years, and will BlackRock be a partner for the medium term?

Yeah, BlackRock's two and a half years into their five-year hold. So we'll see what happens there. We're very fortunate that they've been great partners to date.

I think you're just gonna see from us further expansion on the acquisition front. I think the biggest leap for our company, and where we gain the next big value lever, is entering the U.S. market and proving out our thesis that we built in Canada and proving to investors that we can compete in the U.S.

So with the right capital partner — may it be a BlackRock, or a BlackRock with somebody else, or a completely new private equity firm — we can drive the business.