The U.S. House of Representatives is expected to take up the Inflation Reduction Act on Friday. The reconciliation bill, which the U.S. Senate passed on Sunday, approves new and expanded tax credits for biogas while adding a 1% excise tax on stock buybacks and establishing a 15% corporate minimum tax that could affect the largest of U.S. waste companies.

The primary way to fund the bill is a corporate minimum tax requiring firms with more than $1 billion in annual profits to pay a tax rate of at least 15%, but a late amendment to the tax provision excludes many corporations owned by private equity funds. The tax provision would go into effect for taxable years beginning in 2023, according to a fact sheet from Senate Democrats.

Sen. Kyrsten Sinema, D-Ariz., who led changes to the corporate tax provisions with Sen. John Thune, R-N.D., argued that without the change, small and medium businesses owned by private equity firms could be subject to the tax, The Washington Post reported. Sinema also persuaded lawmakers to cut a separate modified carried interest tax rate provision from the bill.

The National Waste & Recycling Association has voiced strong opposition to the bill’s tax structure because the organization says it will hurt business. Jim Riley, NWRA’s senior vice president of government affairs, says the private equity exemption “alleviates some of our concerns” and will help shield smaller companies that rely on such capital investment. Another welcome tweak to the corporate tax provision, he said, would allow companies to continue to take advantage of accelerated depreciation on new equipment, a rule that allows businesses to deduct the declining value of assets like machinery more quickly than it wears out or otherwise loses value. However, “we still think that increasing taxes during a period of economic uncertainty is a mistake if we are trying to maintain economic growth,” he said.

While a 2021 report from the office of Sen. Elizabeth Warren, D-Mass., listed WM and Republic Services among dozens of companies that did not pay an effective tax rate of 15% in 2020, WM and Republic themselves reported higher effective tax rates for that year. Warren’s report was based on research estimates from the Institute on Taxation and Economic Policy, which did not respond to a request for comment about its methodology. Republic declined to comment on tax rate calculations.

According to WM spokesperson Janette Micelli, “the effective rate in the Warren report was measured based only on WM’s federal and foreign current income tax expense, whereas WM’s reported effective rate is measured using total federal, foreign and state current and deferred income tax expense.” WM also noted the report doesn’t fully reflect a normal tax year, as the company’s income tax expense in 2020 was “unusually reduced by substantial income tax attributes inherited by WM as a result of its acquisition of Advanced Disposal Services,” and the report also didn’t account for other general business credits. As a result, while the company is tracking this legislation, it does not expect a 15% minimum tax “to have a material (if any) impact on WM.”

The U.S. waste industry has multiple other companies with more than $1 billion in annual revenue that could potentially be affected depending on their tax situations.

The bill as passed by the Senate also includes a new 1% excise tax on stock buybacks for publicly traded companies, which could also affect major haulers. During 2021, WM, Republic and Waste Connections reported spending a collective $1.94 billion on stock buybacks and have continued the practice into this year. This included $1.35 billion for WM, $252.2 million for Republic and nearly $339 million for Waste Connections in 2021. A potential 1% tax on that collective activity would yield $19.4 million, a relatively minor expense.

The buybacks could bring in more than $70 billion, according to Reuters, but Riley said the tax won’t have a major impact on waste and recycling businesses. However, “it could impact employees’ 401k and IRA accounts as those are traditionally the beneficiaries of stock buybacks.”

Unchanged from previous versions of the bill is the inclusion of new or expanded tax credits for biogas-producing entities like landfills and anaerobic digesters, which waste and biogas industry representatives have applauded as a move to expand business opportunities and align biogas with other renewable energy sources such as wind and solar.

The bill would expand a renewable energy investment tax credit to include certain biogas operations that begin construction before 2025. It also calls for bolstering credit rates for a carbon sequestration incentive that could apply to waste projects and extending an alternative fuel tax credit that expired last year. Extending the fuel credit would have about a $15 million annual impact for Republic and about a $55 million impact for WM.

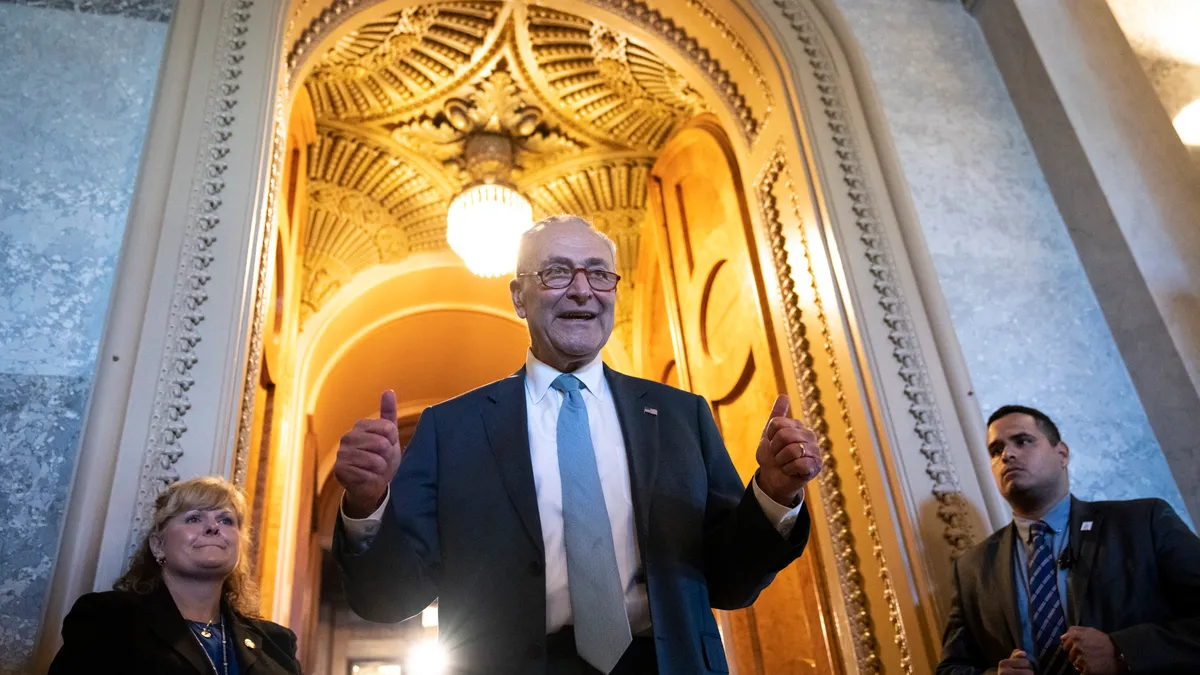

The bill, first introduced July 27 and backed by Senate Majority Leader Chuck Schumer, D-N.Y., and Sen. Joe Manchin, D-W.Va., calls for an estimated $369 billion in energy and climate spending over 10 years. Senate Democrats say the bill will help lower greenhouse gas emissions by 40% (based on 2005 levels) by 2030.

Editor’s note: This story has been updated to include comment from WM.