China's scrap import policies have shaken up the global markets over the past year. As U.S.-based recyclers have been left without purchasers for many recovered materials — especially plastics and fiber — those in the industry have had a renewed focus on boosting domestic infrastructure to handle them instead of relying on foreign markets.

Although many factors play into a business' decision to expand existing infrastructure and capacity, or build an entirely new facility, numerous domestic recyclers have cited China's actions as a driver. The fallout reportedly is a factor pushing forward a domestically owned $20 million plastics recycling facility (PRF) planned for New Jersey. Chinese recycling firms that face import restrictions in their own country also have turned to investing in U.S. recycling facilities, such as a new plastics facility announced for Alabama.

Waste Dive spoke with Ron Gonen, co-Founder and CEO of Closed Loop Partners, about recycling infrastructure and the effects China's regulatory measures have had domestically. Closed Loop Partners is a group that has invested $43 million to date in sustainable consumer goods, advanced recycling technologies and the development of the circular economy.

The following interview has been edited for brevity and clarity.

WASTE DIVE: What are you seeing in terms of domestic recycling infrastructure investments as they relate to China’s regulatory actions?

RON GONEN: We don't view what’s going on with China as necessarily a bad thing for the industry; we actually view it as an opportunity. A major problem for a long time has been people ... producing low quality bales, and they’ve been able to stay in business because they ship those bales to China. A major market like China becoming much stricter on bale quality will force the leading MRF operators to rise to the top to get more business. And the folks out there who are producing low quality bales, it will force them to either produce better quality bales or exit the industry. That's one positive opportunity.

The other positive is we think there's a lot of opportunity to build domestic circular economy recycling infrastructure in North America. Sometimes something like [China's actions] is a great kick in the pants to celebrate that opportunity.

Have you seen more domestic recycling businesses jumping at this opportunity?

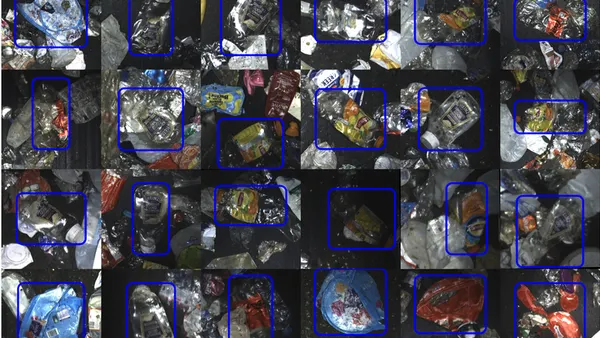

GONEN: Sure, a lot of companies that we're investing in are building that domestic infrastructure. Lakeshore [Recycling] is a good example of a company expanding collection and sortation of recyclables in Illinois and Wisconsin ... We’ve invested in Eureka [Recycling], which has some Minneapolis and St. Paul contracts ... [and] Firstar Fiber in Omaha. [They're all] doing a great job sorting and creating high-quality bales. We invested in AMP Robotics, where robotics and artificial intelligence can help optimize MRF operations and produce higher quality bales ... [and] Momentum and Aero Aggregates; those are two companies that can take MRFs’ glass and turn it into a product. We’ve invested in PureCycle Technologies and GreenMantra, who domestically are de-coloring or de-polymerizing plastics so they can be manufactured into new plastics.

One of Closed Loop Partners' first investments was the PRF that opened in Dundalk, Md. in 2015, which idled last year. Is that expected to reopen?

GONEN: We do expect it to reopen this year. We're looking for a buyer for the facility, but we're very confident the facility can operate profitably. It’s just a matter of finding the best-in-class operator to take over the facility. We still believe that there’s a definite market for the types of sortation capability that the facility has. We as the investors still see a lot of potential and opportunity in the business model.

Do you believe the market conditions are different now and that might affect recycling operations?

GONEN: We take a long-term view on the recycling industry, and [it] has had plenty of ups and downs. If you look at folks in the industry over a number of years who have had best-in-class practices … they’ve done very well. I think it's a mistake to look at six-month or one-year snapshots where commodity prices are low, just as it’s not good to get too excited when commodity prices are too high.

We take the same view, with an added opportunity: We understand that consumer goods companies and retailers want to be using more recycled content, if the quality of the bales can be improved and they can get enough supply. We also see significant long-term opportunities from a demand standpoint and pricing standpoint for MRFs to produce high quality bales as a supply that’s relevant to major supply chains.

Have you noticed more China-based companies looking to invest in U.S. recycling infrastructure?

GONEN: Yes, absolutely. We actually had a group of 40 Chinese recycling companies … asking us about investment opportunities in North America. They see the same opportunity [that we do], that China is going to restrict the amount of material coming in, but the Chinese manufacturers want access to this material. So maybe the best way to do it is actually invest in North American companies ... which makes it easier for that material to get into Chinese markets.

Is it a challenge for the Chinese investors to get involved in the North American markets with all of China’s regulatory actions?

GONEN: I think it's a challenge … but the Chinese have become very adept over the last decade in investing in the United States... They’ll figure their way into the market.

We’re not actually involved in advising them or co-investing with them at this point. But interest was expressed to us as legitimate investment decisions. There’s a lot of interest among the Chinese for investing in U.S. infrastructure.

You've noted numerous successful domestic recycling industry players. Do you think the China situation is just a blip and the recycling industry will survive?

GONEN: Absolutely. If you look at the strongest operators in the industry, they're not massively impacted by what's going on in China because they produce high-quality bales ... It's not to say that China isn't having an impact in all parts of the system and all parts of the country ... But if they have a commitment to the recycling industry in the long term, this is a golden opportunity to make some investments that really will pay back handsomely. PET, HDPE, aluminum [and] cardboard, throughout this whole China issue, are still selling very well.

We see a lot of opportunities for investing in recycling infrastructure and the circular economy. This is what municipal customers want; they don’t want to pay to send material to landfill. This is what commercial customers want; they don’t want to pay to send material to landfill. This is what the largest retailers and companies want; they want to use this material in manufacturing their products.

All the major consumer brands — Coca-Cola, PepsiCo, Procter & Gamble, Unilever — have all expressed interest in buying and using as much recycled content as they possibly can get their hands on. That’s a good signal for the market, that if you can produce high quality bales in the right areas, there are going to be buyers.

If we think about who the customers are in the waste and recycling value chain, they're all aligned in terms of a primary focus on recycling. There’s an opportunity for us in the recycling industry to develop processes and the infrastructure and services to take advantage of their interests.