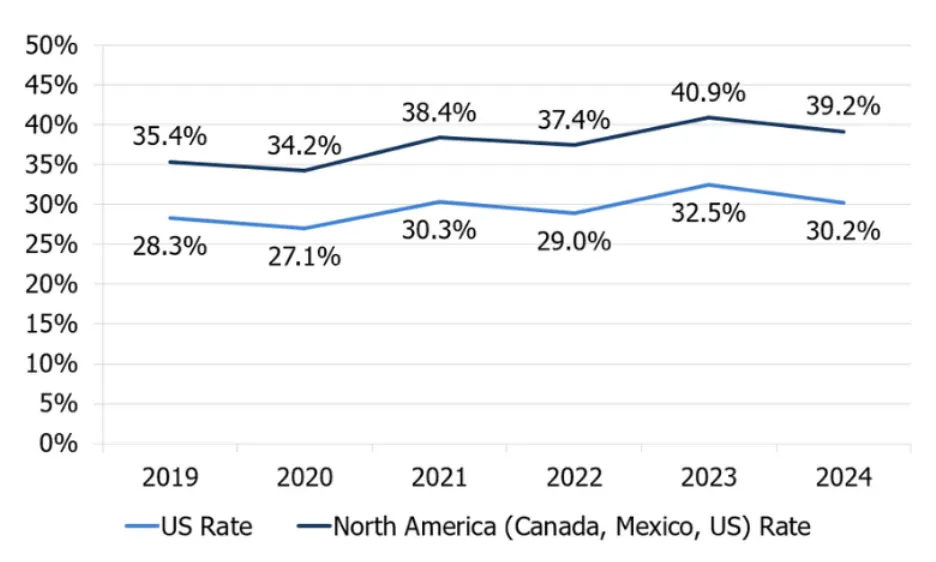

The National Association of PET Container Resources (NAPCOR) shared its 30th annual analysis of PET recycling in the U.S. and Canada this week. The report covers data from 2024, determining a U.S. PET bottle collection rate of 30.2% and a broader North American rate of 39.2%. The average level of recycled content in U.S. bottles was 15.9%.

Lauren Laibach, director of data services, explained that NAPCOR surveyed 30 reclaimers in the U.S. and Canada. NAPCOR measures PET collection at the point of reclaimer purchase, but it does not factor in losses that might happen during sortation at MRFs. Bottle availability for recycling is calculated based on sales of resin from North American producers and imports. NAPCOR makes deductions for very small-volume bottles that would get lost in sortation machinery, as well as manufacturing scrap.

These are four points on recycling and recycled content that Laibach highlighted following the most recent analysis:

1. Non-bottle feedstock in PET recycling is becoming more prominent

While PET bottles are the oldest and still most prevalent type of PET packaging that gets recycled, NAPCOR observed a notable increase in PET thermoforms recovered in 2024, said Laibach. “That's been a growing trend as the fraction of curbside bales taken up by thermoforms has grown.”

Another trend — the lightweighting of PET bottles — also means that thermoforms are taking up a greater share of bale weight, she said.

There aren’t a lot of dedicated thermoform bales that get recycled in the U.S. and Canada; many of them get exported to Mexico, Laibach said. “The high levels of thermoforms in curbside sales means that, ultimately, PET that was thermoforms is getting incorporated into new applications, just by nature of being reclaimed with bottles.”

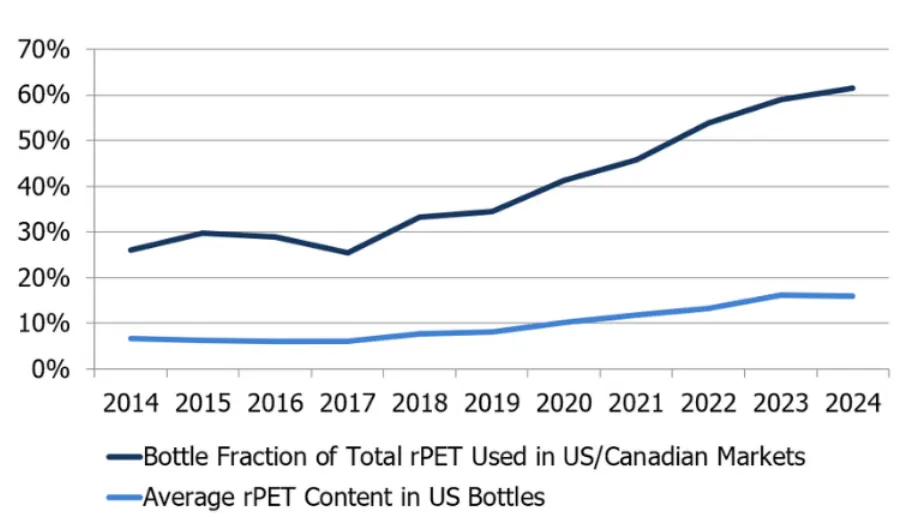

2. rPET growth in bottles began to flatten

Using recycled PET in bottles “was a trend that was growing rapidly, and it really flattened off in 2024” for the first time since 2018, Laibach said. “So that story we've been telling of growing and growing bottle consumption of rPET — it grew slightly in 2024, but not anywhere near to the extent it had been.”

Laibach acknowledged various external catalysts that have shifted since 2018.

One example is California’s law mandating recycled content minimums in plastic beverage containers. AB 793 required 25% postconsumer plastic by 2025, but the next jump — to 50% — isn’t until 2030. Once initial levels were satisfied, “maybe then the incentive to continue to grow that was a little bit less, until the next time that the level steps up legislatively,” Laibach said.

Outside of regulations, “we have also seen some walking back of those corporate commitments to use more content,” she said, suspecting that “low-hanging fruit has been taken up, and it's becoming a little bit more expensive and difficult to procure the recycled content needed to continue to grow that.”

3. Domestic rPET is being challenged by imports, virgin

Sales of rPET to end markets fell between 2023 and 2024.

“There was also a bigger share of imported rPET that took up some of what domestic U.S. and Canadian reclaimers were selling into the market the previous year,” Laibach said.

“That's due to price dynamics; lower-cost imports obviously are competitive with domestic rPET, and there was a high premium for domestic rPET over virgin PET, so there may have been substitution to virgin in certain products as well,” she added.

4. Capacity reductions could impact 2025 data

While this report covered 2024 data, there have been factors at play this year that could impact next year’s report covering 2025. A few plant closures could translate to lower demand for bales, and a higher fraction of bales could be exported from the U.S. to Canada or Mexico.

“I think it would be reasonable to expect a decrease in the numbers for 2025, just given that we've got I think a 15% reduction in reclamation capacity based on the closures that have taken place this year,” Laibach said.

In recent news, Phoenix Technologies disclosed it’s closing its rPET facility in Ohio. This year in California, PET recycler and packaging manufacturer rPlanet Earth closed and PET bottle recycler Evergreen Recycling downsized.