Mergers and Acquisitions: Page 11

-

Archaea revenue grows, RNG output rises ahead of sale to BP

The Texas-based company, which specializes in creating energy from gas at landfills and other sites, continues to ramp up operations. A date has also been set for shareholders to approve its $4.1 billion sale to BP.

By Cole Rosengren • Nov. 14, 2022 -

Rubicon pledges ‘progress to profitability’ and shares plans to grow company’s earnings potential

In Rubicon’s first earnings call since going public and seeing its founder step down, CEO Phil Rodoni named “profitability as the core tenet of our strategy and corporate culture going forward” and announced a new company president.

By Cole Rosengren • Nov. 10, 2022 -

Q&A

What’s next for Veransa, the new company consolidating Florida’s green waste composting market

The private equity-backed company has completed three acquisitions since launching last year. A vice president shares the company's growth agenda and how it has been handling Hurricane Ian debris.

By Cole Rosengren • Nov. 9, 2022 -

Facing falling recycled commodity prices, waste companies pivot in Q3

After enjoying increasing recycled commodity values for the first half of 2022, industry operators faced major commodity price declines.

By Megan Quinn • Nov. 4, 2022 -

Top waste companies spent $1.1B on Q3 acquisitions, with more to come

Here’s what executives at the industry’s largest companies had to say about the M&A environment this year — and how much each has spent.

By Cole Rosengren • Nov. 4, 2022 -

GFL 2022 earnings

GFL Q3 revenue jumps, ESG targets to come this month

GFL Environmental’s revenue bump came amid economic headwinds and notable costs related to fuel, trucks and MRF fires, as discussed on its earnings call Thursday.

By Maria Rachal • Nov. 3, 2022 -

WCN 2022 earnings

Waste Connections says pricing strategy helped achieve solid Q3

Higher activity in waste treatment services related to oil and gas, up 52% from last quarter, was a strong point amid inflation and “precipitous” declines in recycled commodity prices, especially for OCC, CEO Worthing Jackman said.

By Megan Quinn • Nov. 3, 2022 -

Waste Connections reports a decline in GHG emissions despite acquisitions, sets new ESG targets

The company plans investments in RNG facilities, MRFs and electric collection vehicles as well as new goals to cut Scope 1 and 2 emissions by 15%, building on a recent decline of 7%, it said in its 2022 sustainability report.

By Cole Rosengren • Oct. 31, 2022 -

Q3 earnings results for major waste and recycling companies

Follow the latest round of financial results from WM, Republic Services, Casella Waste Systems, Waste Connections, GFL Environmental and more.

Updated Dec. 1, 2022 -

CWST 2022 earnings

Casella reports 13 acquisitions in 2022, sees M&A opportunity in potential recession

The Vermont-based company said its pricing and fee strategy have worked well in a tight economic environment. Executives also previewed upcoming plans for acquisition and landfill expansion spending.

By Cole Rosengren • Oct. 28, 2022 -

RSG 2022 earnings

Republic Services pricing at record highs as it fights recycled commodity price declines and cost inflation

The company is still integrating US Ecology while returning M&A focus to solid waste and recycling. Leaders also noted in an earnings call the opportunity to work with BP, which is buying renewable natural gas projects partner Archaea.

By Maria Rachal • Oct. 28, 2022 -

Casella narrows ESG focus to 5 key targets for 2030

The Vermont-based company previously set 10 ESG targets in its 2020 report but has narrowed the focus to five key metrics related to emissions reduction, recycling volumes, fleet efficiency and more.

By Cole Rosengren • Oct. 27, 2022 -

WM 2022 earnings

WM spent nearly $200M on acquisitions in Q3, outlines future potential of big ESG investments

Recycling revenues are taking a hit, but executives said their updated contract models will provide insulation. CEO Jim Fish also shared a goal to eventually expand margins via price increases, not just recover costs.

By Cole Rosengren • Oct. 26, 2022 -

Retrieved from YouTube on October 21, 2022

Retrieved from YouTube on October 21, 2022

Rubicon’s stock has struggled since going public. Is the SPAC trend to blame?

The tech company — which brokers waste and recycling services — rang the opening bell on Wall Street this week after its stock price declined and its founder stepped down as CEO. Analysts say a turnaround is still possible.

By Cole Rosengren • Oct. 21, 2022 -

Waste Connections purchasing California company Upper Valley Disposal

Upper Valley provides a range of collection, recycling, composting and disposal services in Napa County. Following the recent death of founder Bob Pestoni, the family decided to sell its multigenerational business.

By Cole Rosengren • Oct. 19, 2022 -

BP acquiring landfill RNG company Archaea for $4.1B

The pending transaction comes barely a year after Archaea Energy, a fast-growing developer of landfill gas projects, went public. The deal is described as a way for BP to support customers’ decarbonization goals.

By Cole Rosengren • Oct. 17, 2022 -

Reuse tech startup Rheaply targets C&D waste with Materials Marketplace acquisition

CEO Garry Cooper says adding the platform from the U.S. Business Council for Sustainable Development will expand Rheaply’s reach and allow existing customers to exchange items more broadly.

By Maria Rachal • Oct. 10, 2022 -

RoadRunner Recycling buys Compology to scale AI, metering in collection service

RoadRunner, which provides service through third-party haulers, has raised nearly $130 million to date as it scales quickly. Compology’s AI and camera capabilities will expand its data offerings for ESG-driven customers.

By Cole Rosengren • Oct. 6, 2022 -

Waste Connections acquires Rogue Disposal & Recycling, notable southern Oregon company

The transaction gives the company a foothold in the region, with a range of franchise hauling operations, a transfer station, composting facility, CNG fueling station and a large landfill.

By Cole Rosengren • Oct. 5, 2022 -

Q&A

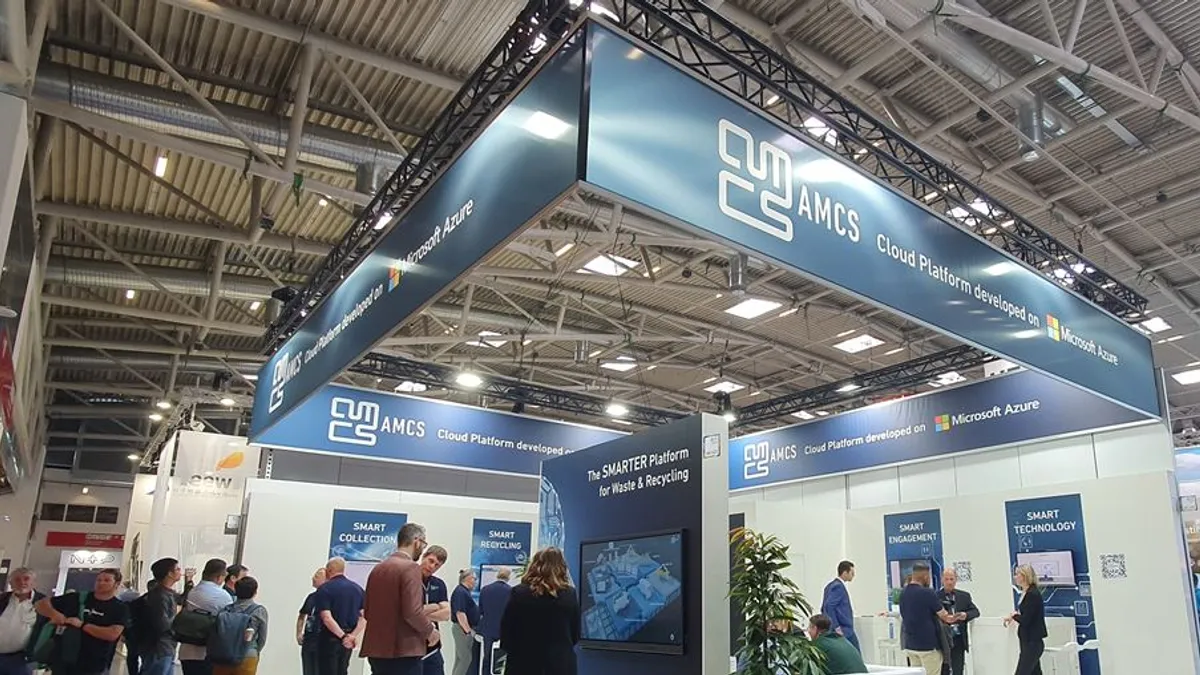

AMCS sees opportunity to advance tech adoption amid waste industry consolidation

North America President Michael Winton discusses the company’s mix of new and existing business, areas for further AI applications and more.

By Maria Rachal • Oct. 4, 2022 -

Strategic Materials acquires Ripple Glass, plans to grow collection beyond current Midwest footprint

SMI, North America’s largest glass recycler, sees Ripple as an expert in engaging residents. Started by a Kansas City, Missouri, brewery in 2009, Ripple has since grown to offer services in multiple states.

By Cole Rosengren • Sept. 28, 2022 -

Deep Dive // NYC commercial waste reform

Los Angeles had a rocky commercial waste zone rollout but is seeing results. What’s in store for New York?

New York has big goals for its zone system to boost diversion rates, infrastructure investment and labor standards. First, the city and haulers must navigate a transition process that one LA official called “six months of hell.”

By Cole Rosengren • Sept. 19, 2022 -

Renovare Environmental CEO steps down, reverse merger with Harp Renewables still pending

Details about the fate of the small-scale digester company remain limited, but it’s now working to raise new funding and pay off debt ahead of a possible transaction. In the meantime, CEO Tony Fuller is out.

By Cole Rosengren • Sept. 14, 2022 -

Deep Dive

National Sword kicked off a wave of MRF investments. 5 years later, tech and funding continue to advance.

While the initial shock led facility operators to scramble, many have since invested millions in new equipment to improve material quality. Now, brand commitments and state policies are expected to be the next big market drivers.

By Megan Quinn • Sept. 14, 2022 -

Q&A

WM’s VP of recycling discusses what the Avangard acquisition means for plastic markets

WM has invested in secondary processing ventures before, but VP Brent Bell said the market conditions make this round different. He also shared what the deal could mean for a Honeywell chemical recycling proposal and more.

By Cole Rosengren • Sept. 14, 2022